The Hanover Story

Redefining the Banking Experience

If traditional banking cultures are formal, stark, and a little too buttoned up, ours is – client-focused, welcoming, flexible, and warm. Because we too live where we work, we often see our clients on the ball field, in restaurants, and at the local grocery store. We believe that banking should be about people, not account numbers.

We know the greatest investment Hanover Bank can make doesn’t involve dollars, but rather in the commitment we make to our communities. When you put your trust in us, we strive to exceed your expectations every day, and every time.

Since our founding, we have grown, always with the goal of how to best serve our clients.

Here are some key milestones in our history.

2009

2019

2021

2022

The Best of Commercial & Personal Banking

Imagine working with a bank that not only knows your name, but also sincerely wants to help you achieve your financial goals. We provide a wide range of first-class commercial and personal banking products and financial services, with competitive rates and flexible terms to meet your specific needs. Our Hanover team offers everything the big banks do, but with the personal service you deserve.

We allow you the freedom to tell us how you’d like to bank. Whether you visit one of our modern-designed branches or leverage the best of today’s innovative digital banking technology, our goal is to build a relationship that makes your life easier and more convenient by delivering meaningful value with every interaction.

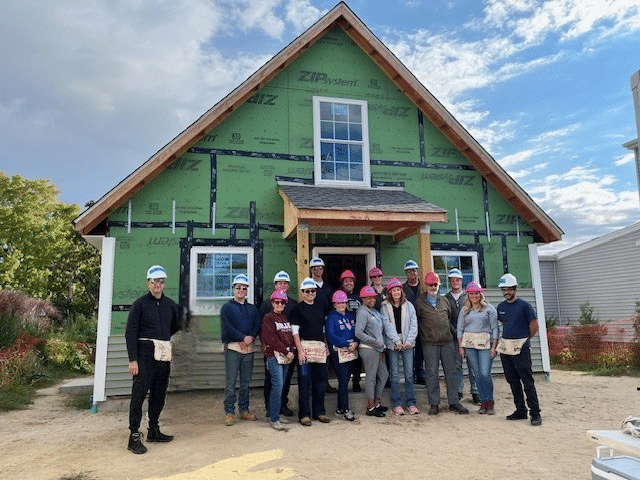

Valuing People & Community

Hanover Bank is proud to hire professionals who live and work in the communities we serve. From the time of our founding, service to others has been at the core of our culture. We are committed to supporting our neighbors and always looking for the opportunities to make a difference.

Be a part of the Hanover Story!

If you are looking for a banking partner who values your unique business and personal financial goals and has the tools and resources to help you make it happen, we think Hanover Bank is the bank for you.