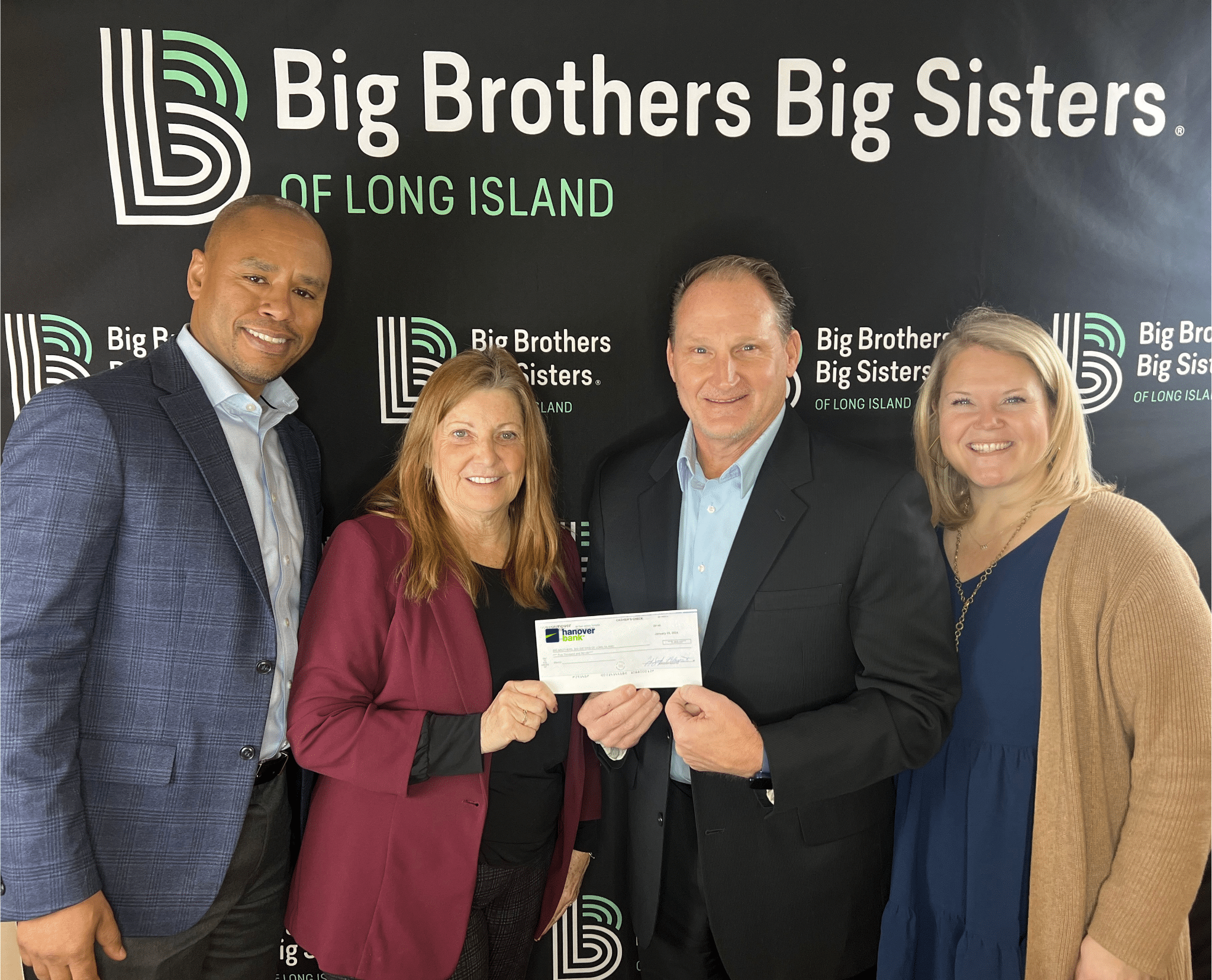

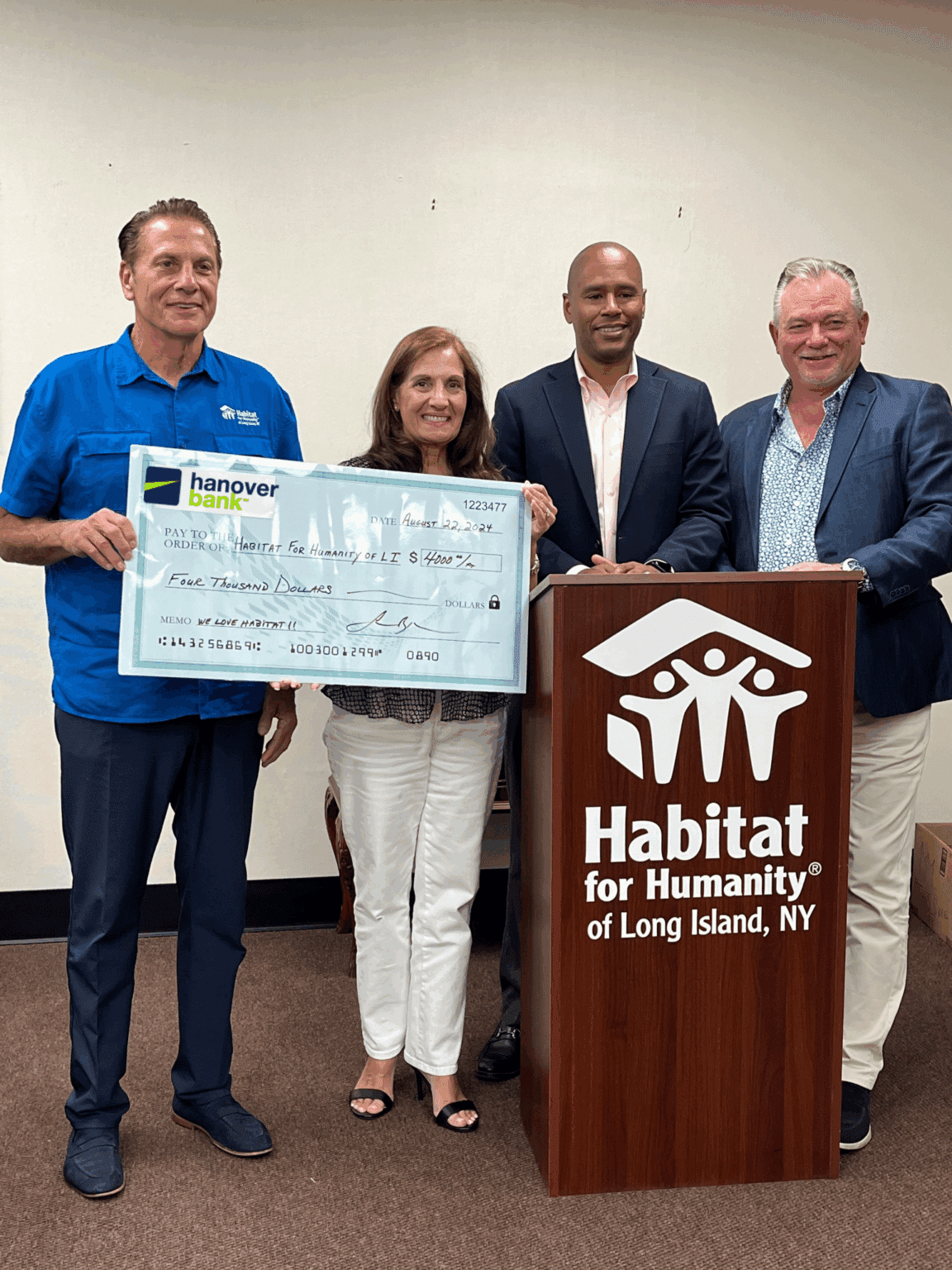

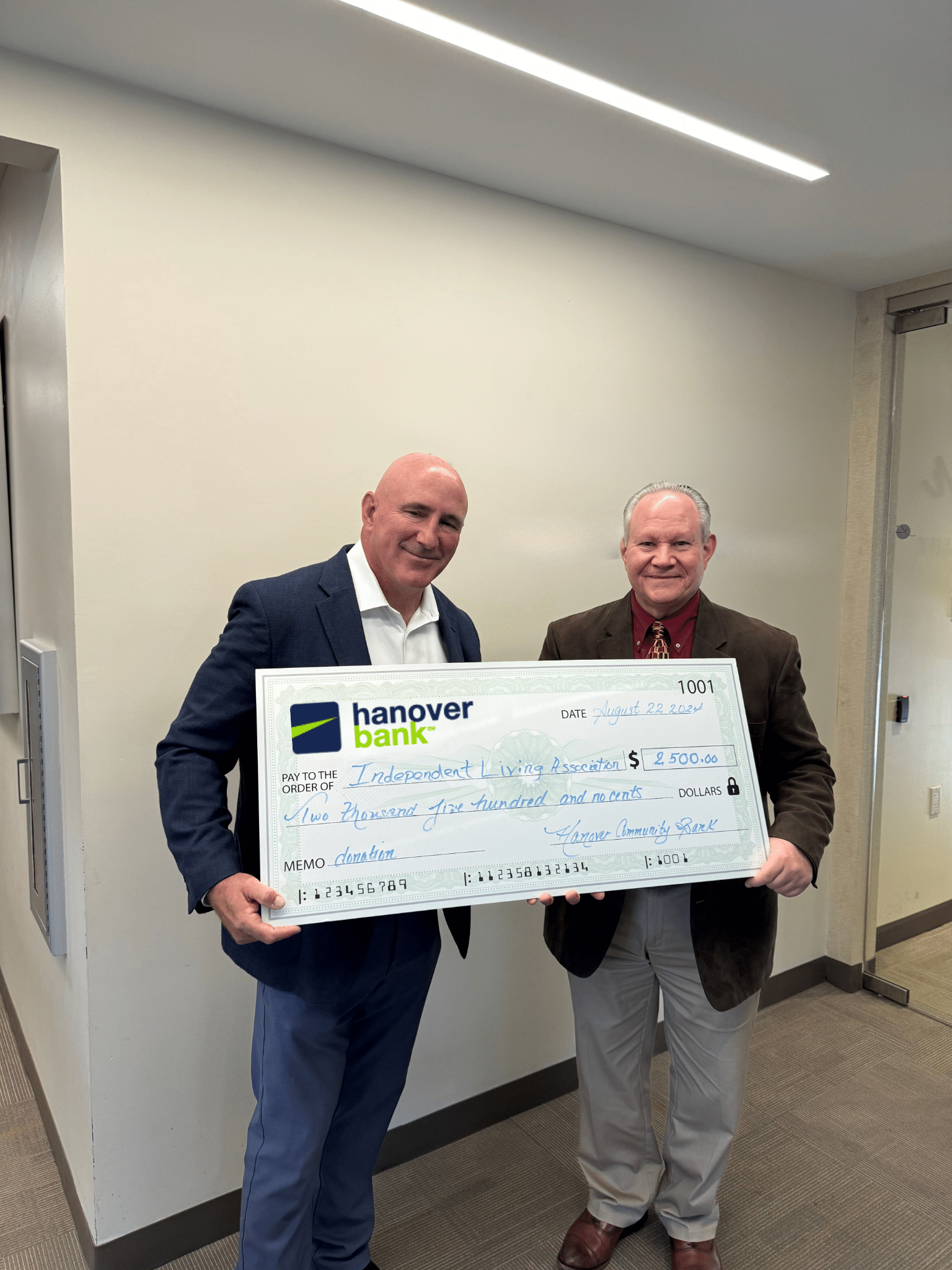

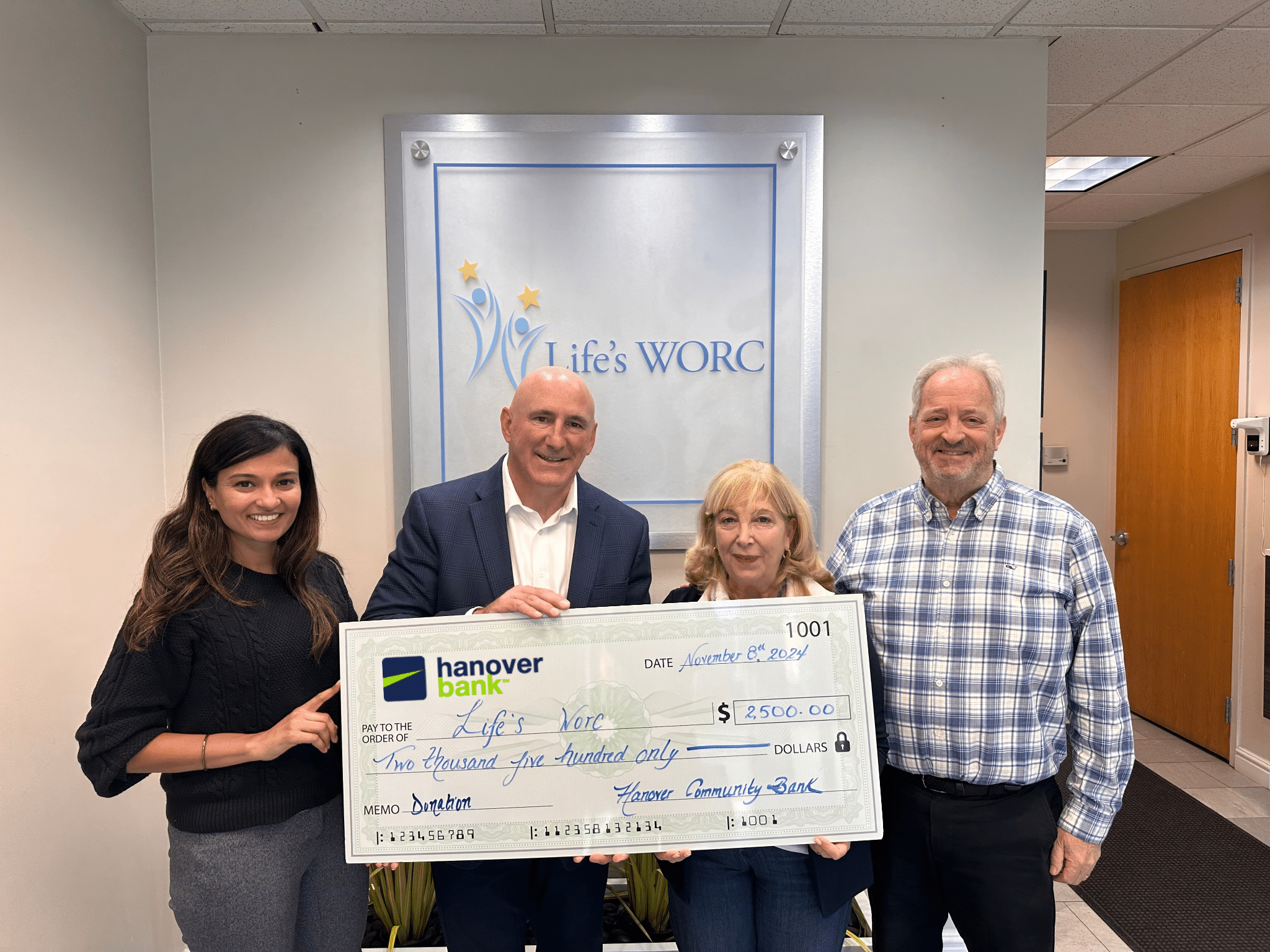

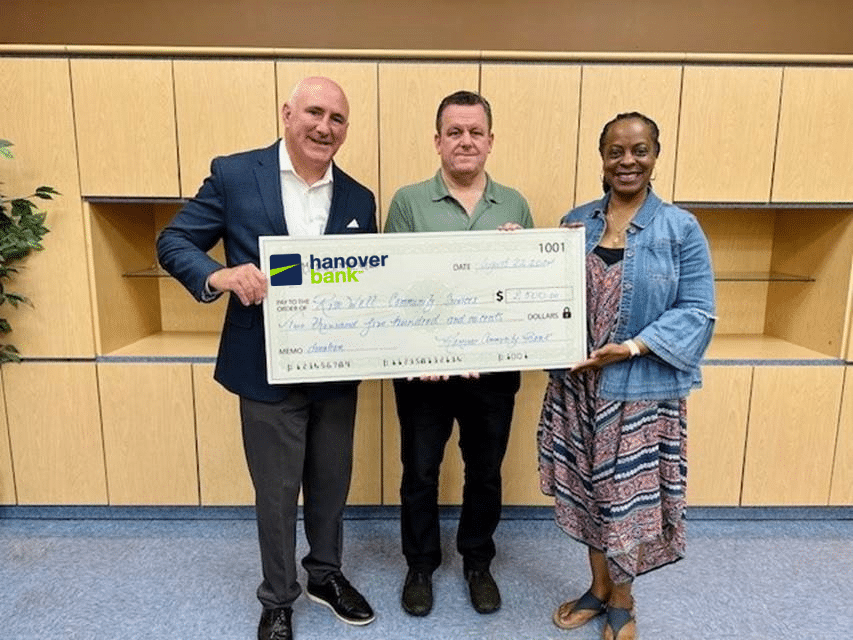

Together We Make a Difference in Our Communities

From the time Hanover Bank was founded, service to others has been at the core of who we are. We are proud to stand alongside our neighbors in helping to make the communities in which we live and work better for everyone.

Whether it be through offering banking products that help our clients’ businesses thrive, donating to outstanding charitable organizations, or volunteering our time, Hanover’s mission is to do our part to help build stronger, healthier, and more connected communities.

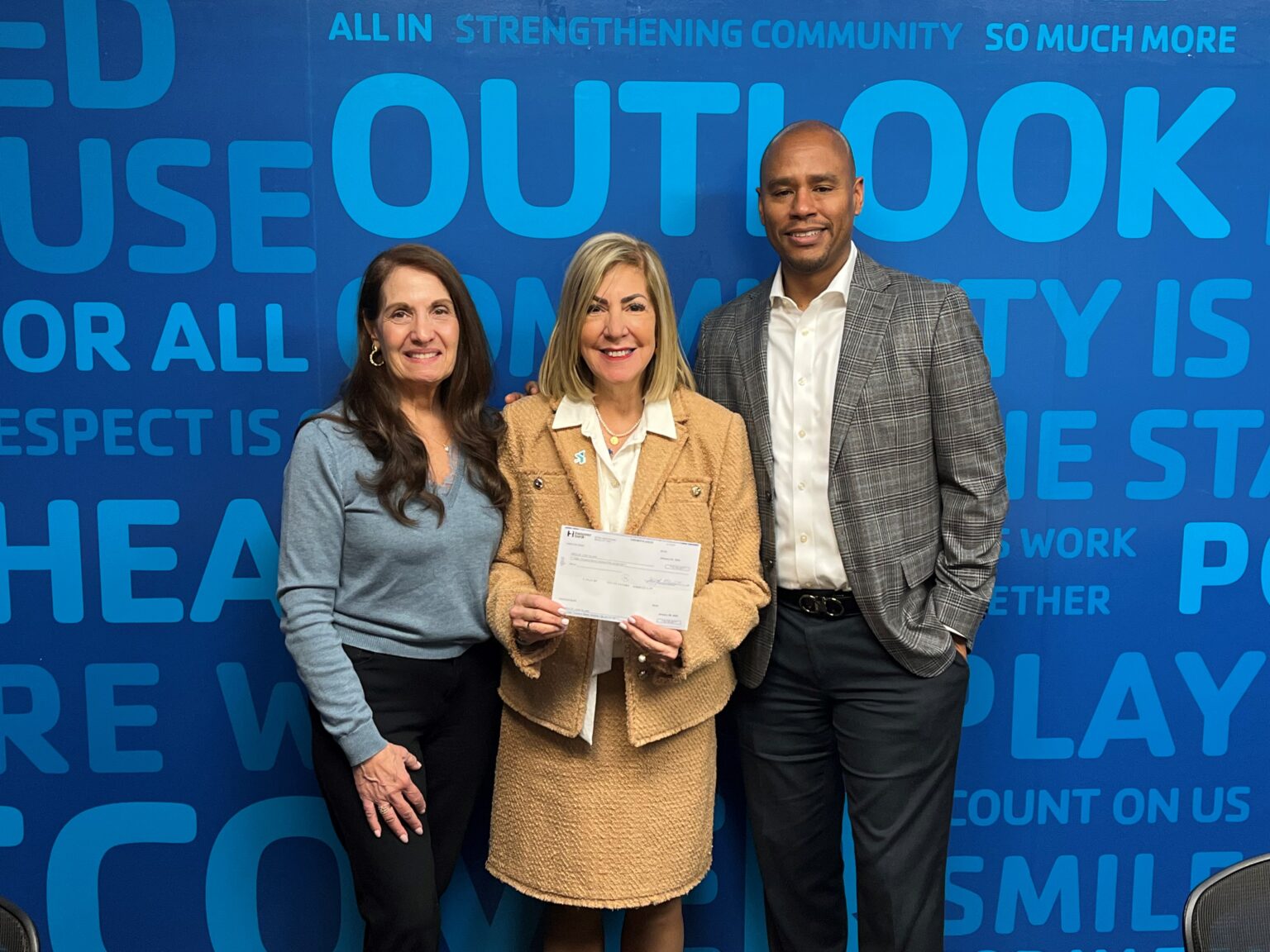

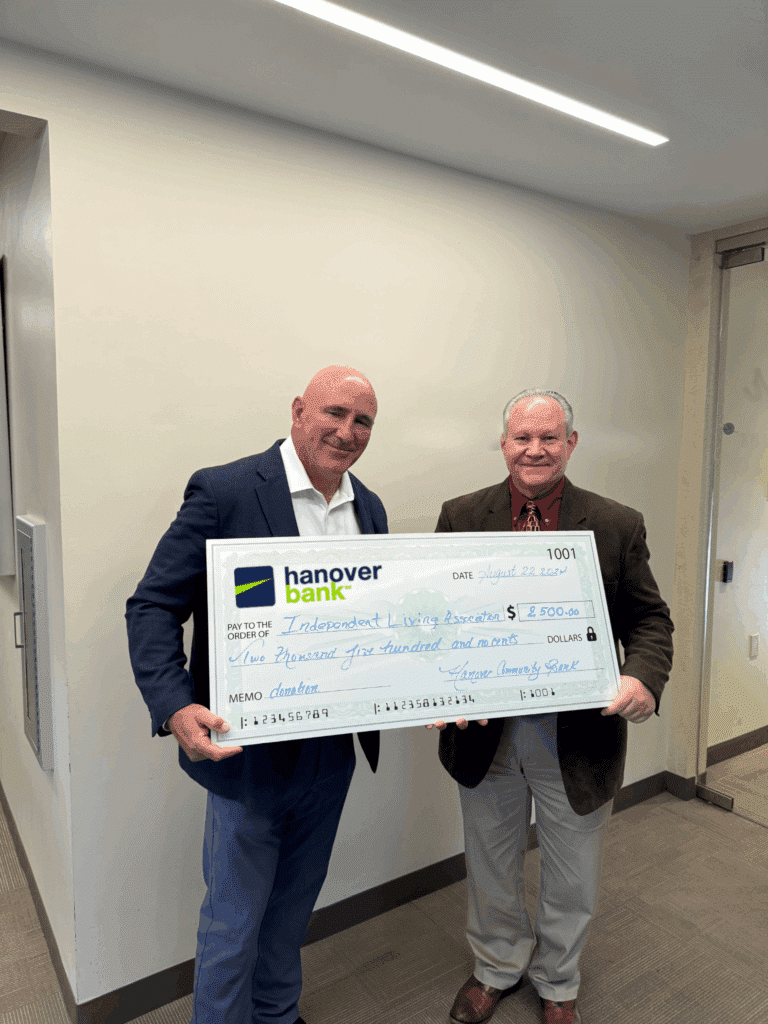

Building Bridges, Not Just Balances

Hanover is in the banking business, but we like to say we are actually in the people business. Everyone deserves the chance to grow, thrive, and reach their greatest potential.

We are not content with progress that leaves others behind. Together, we can uplift those facing challenges so that everyone has the opportunity to shape a brighter future.